Beijing, June 5, 2025 — China’s foreign exchange reserves rose slightly to $3.285 trillion by the end of May, up 0.11% from April, while the People’s Bank of China (PBOC) continued its strategic gold accumulation for the seventh consecutive month, data from official sources showed. Gold reserves reached 73.83 million ounces in May, a monthly increase of 60,000 ounces, reinforcing trends of diversifying international reserve assets.

Modest Foreign Reserve Growth Amid Currency and Asset Market Dynamics

Analyzing the marginal rise in foreign reserves, Wang Qing, Chief Macro Analyst at Dongfang Jincheng, highlighted two key factors:

Stabilizing U.S. Dollar Dynamics: The USD index fell just 0.2% in May compared to April, significantly dampening the appreciation effect of non-USD assets in China’s reserve portfolio. This followed reduced U.S.-China tariff tensions and a easing of capital outflows from USD assets, which had driven the dollar’s near-10% decline over the prior five months—a pace historically comparable only to the post-1985 Plaza Accord era. With stable U.S. economic fundamentals, excessive market pessimism toward the dollar has subsided, fostering renewed currency resilience.

Balanced Global Asset Performance: Post-U.S.-China joint statement in May, global equities surged, but rising U.S. Treasury yields—driven by fiscal reform efforts under the Trump administration—weighed on bond prices. This created a hedging effect, leaving the overall valuation of financial assets in China’s reserves largely unchanged.

Wang noted that China’s reserves, slightly above $3 trillion, remain “moderately ample” by international standards, providing a stable foundation for RMB exchange rate stability and shock absorption amid external volatility.

Strategic Gold Accumulation: Addressing Structural and Long-Term Goals

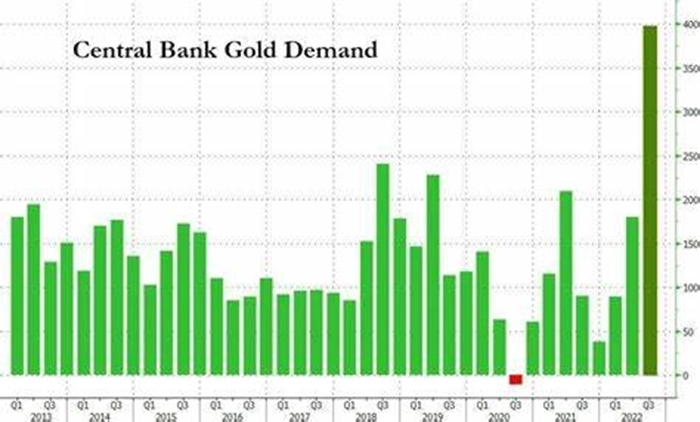

The PBOC’s continued gold purchases align with market expectations, even as May’s reduced tariff tensions temporarily eased safe-haven demand and triggered a minor gold price correction. Key strategic drivers include:

Geopolitical and Economic Uncertainty: Evolving global dynamics following the U.S. leadership transition suggest sustained upward pressure on gold prices, diminishing incentives to pause purchases for cost control while amplifying needs to diversify reserves.

Portfolio Imbalance: Gold accounts for just 0%of China’s official international reserves, well below the global average of ~15%, highlighting significant room for structural optimization.

RMB Internationalization: As a globally accepted reserve asset, increased gold holdings strengthen the RMB’s credibility and support its growing international role.

Outlook: Wang emphasized that gold accumulation will remain a core policy priority. “Sustained purchases are essential to optimize reserve composition, advance RMB internationalization, and navigate geopolitical shifts,” he stated, noting the urgency of addressing the current low gold allocation.

Related topics: